indiana excise tax alcohol

And for wine the pay an extra 47 cents. The northern state of Uttar Pradesh made the highest estimated revenue from excise duty on alcohol at about 315 billion Indian rupees across India in financial year 2020.

Alcohol Taxes On Beer Wine Spirits Federal State

The Indiana State Excise Police is the law enforcement division of the Alcohol Tobacco Commission.

. For more information about cigarette excise taxes or other tobacco product excise tax contact DOR Special Tax Division at incigtaxdoringov or 317-615-2710. Gallons Received During Reporting Month from. A tax rate of 270 per proof gallon on the first 100000 proof gallons in production.

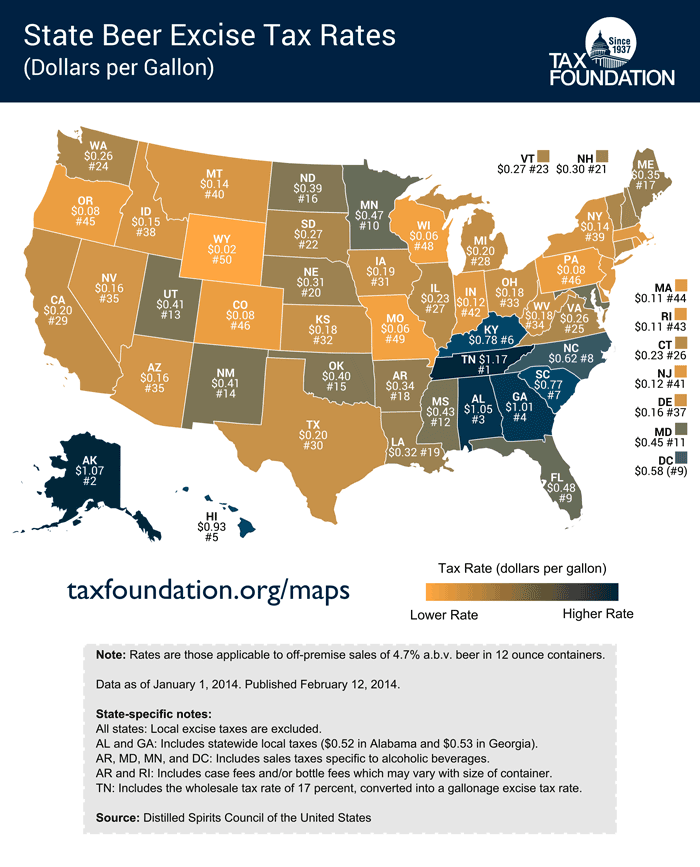

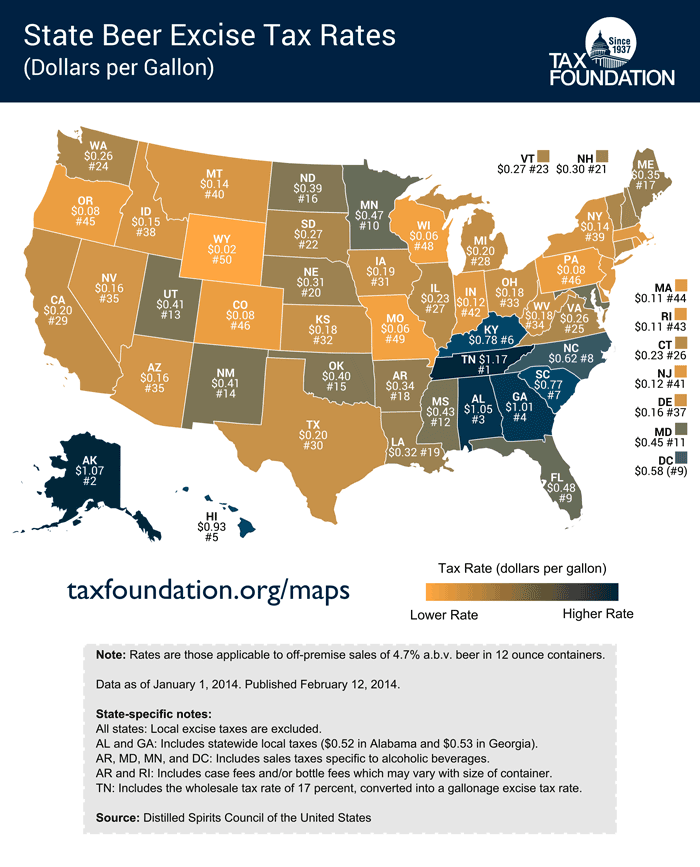

Alcoholic Beverage Wholesalers Excise Tax Return. Excise Tax Calculation BEER Tax rate 0115 CIDER Tax rate 0115 LIQUOR Tax rate 268 WINE Tax rate 047 1. Bond Bank Indiana.

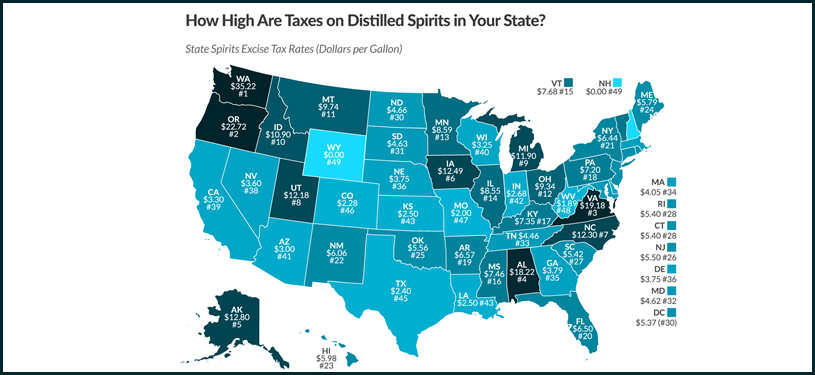

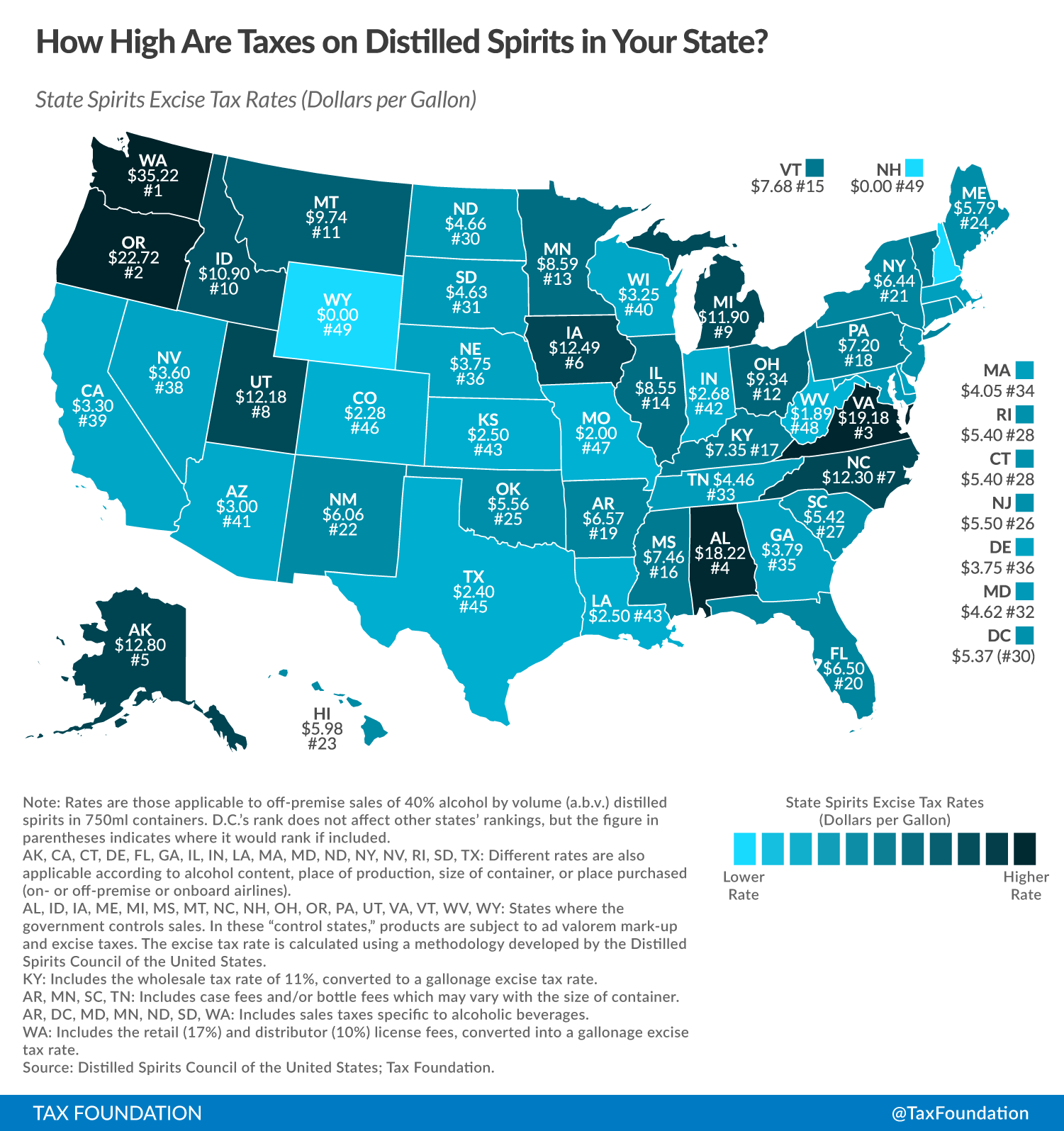

An excise tax at the rate of two dollars and sixty-eight cents 268 a gallon is imposed upon the sale gift or the withdrawal. Indiana Liquor Tax 268 gallon Indianas general sales tax of 7 also applies to the purchase of liquor. Missouri taxes are the next lightest at 200 a gallon followed by Colorado 228 Texas 240 and Kansas 250.

However hours for carryout alcohol sales from liquor stores groceries pharmacies. Like many excise taxes the treatment of spirits varies. For more information about.

House Bill 1604 would raise the excise tax on liquor beer and wine sales by 100. Although electronic filing is required paper forms with instructions are available so customers can visualize what is required. Alcohol.

Indiana Alcoholic Beverage Permit Numbers Section B. Indiana Alcoholic Beverage Permit Numbers Section B. 3 rows Indiana Liquor Tax - 268 gallon.

As of January 1 2020 the current federal alcohol excise tax rates are. A tax rate of 1334 per proof. State law permits the sale of alcohol from 7 am.

School for the Deaf Indiana. Purchasers of spirits in Indiana have to pay a state excise tax of 268 per gallon. The price of all motor fuel sold in Indiana also includes Federal motor fuel excise taxes which are collected from the manufacturer by the IRS and are used to support the Federal Highway.

In Indiana liquor vendors are responsible for paying a state excise. Alcohol Taxes in Indiana. This 42 million tax hike alone would cause the price of distilled spirits to rise by 7 and would.

Ad Avalara solutions can help you determine excise tax and sales tax with greater accuracy. School for the Deaf Indiana. State Excise police officers are empowered by statute to enforce the laws and.

The paper forms with instructions shown below are available so customers can visualize what is required. Supporting Schedule to be filed with Monthly Excise Tax Return ALC-DWS-S Indiana Sales Use Tax ST-103 Instructions form mailed to taxpayer. Consumers pay 268 per gallon 637 per 9 L cs and 053 per 750ml bottle.

Can you buy alcohol in Indiana on. Taxes Finance. Visit Electronic Filing for Alcohol Taxpayers for filing information.

Auditor of State. Indiana has a state excise tax. Ethics Commission Indiana State.

Indianas excise tax on gasoline is ranked 19 out of the 50 states. For beer they pay an extra 11 and one-half cents. The Indiana excise tax on gasoline is 1800 per gallon higher then 62 of the other 50 states.

Indianas general sales tax of 7 also applies to the. Excise Tax Calculation BEER Tax rate 0115 CIDER Tax rate 0115 LIQUOR Tax rate 268 WINE Tax rate 047 1.

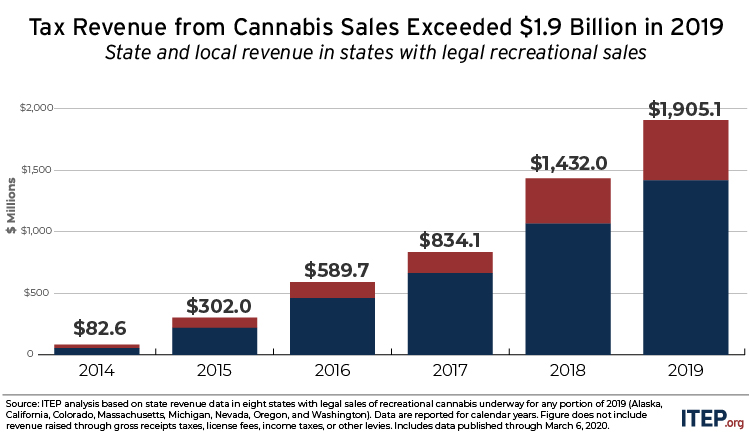

State And Local Cannabis Tax Revenue Jumps 33 Surpassing 1 9 Billion In 2019 Itep

Part 2 How High Are Distilled Spirits Excise Taxes In Your State Infographic Distillery Trail

Indiana Alcohol Taxes Liquor Wine And Beer Taxes For 2022

Part 2 How High Are Distilled Spirits Excise Taxes In Your State Infographic Distillery Trail

Kansas Alcohol Taxes Liquor Wine And Beer Taxes For 2022

State Alcohol Excise Tax Rates Tax Policy Center

Liqour Taxes How High Are Distilled Spirits Taxes In Your State

What States Have The Highest Alcohol Excise Taxes Alcohol Taxes Explained Diy Distilling

Motor Fuel Taxes Urban Institute

These States Have The Highest And Lowest Alcohol Taxes

Indiana Alcohol Taxes Liquor Wine And Beer Taxes For 2022

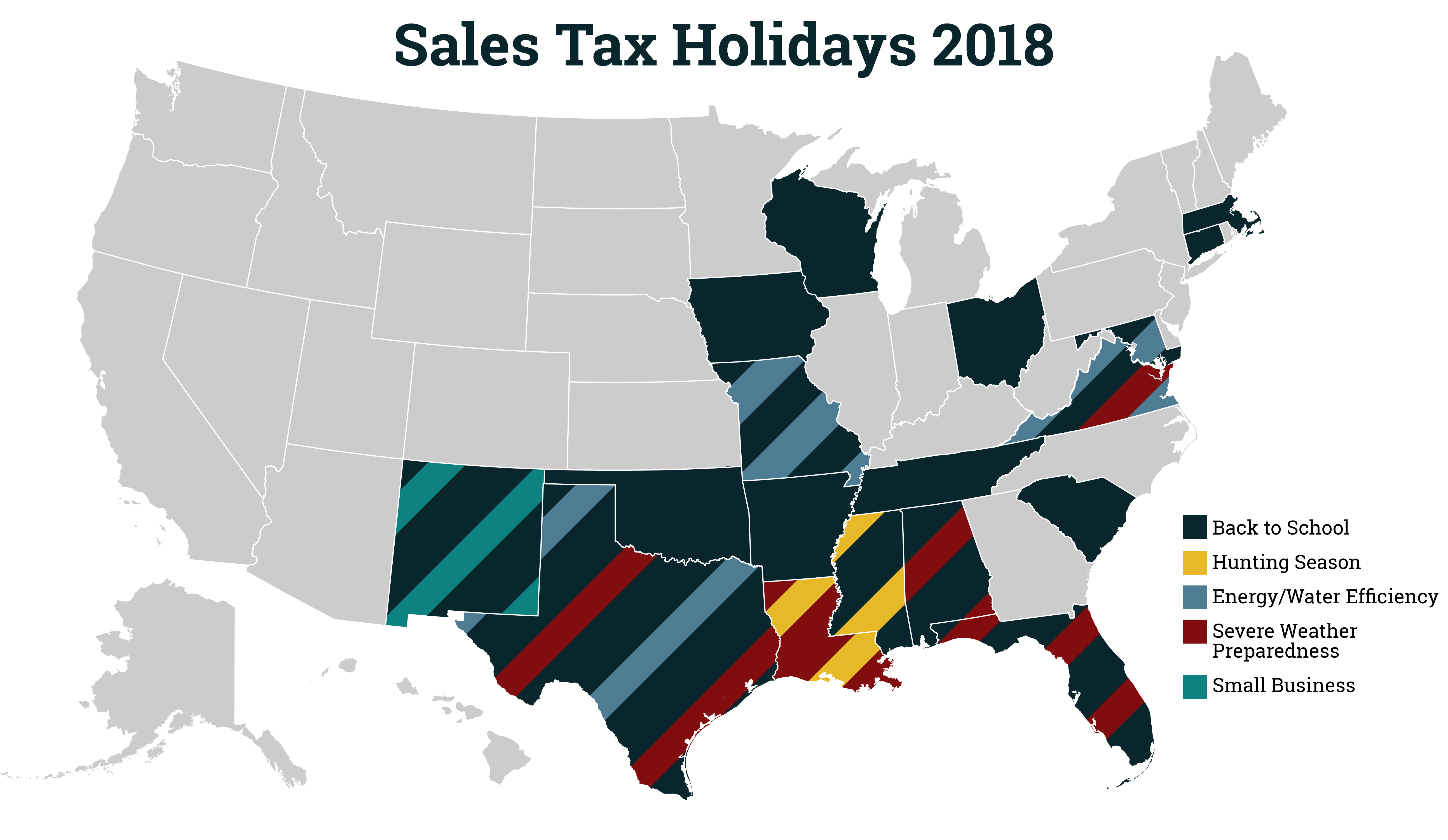

Sales Tax Holidays An Ineffective Alternative To Real Sales Tax Reform Itep

Texas Excise Taxes Gasoline Cigarette And Alcohol Taxes For 2015 Clip Art Petrol Gas

Sales Tax Is Called A Regressive Tax Because People Who Make Less Money End Up Spending A Larger Portion Of Their Pay Infographic Math Review Finance Investing

Bottle Racket Illinois High Alcohol Taxes Blow Up Cost Of Independence Day Celebrations

What States Have The Highest Alcohol Excise Taxes Alcohol Taxes Explained Diy Distilling